How the 50-30-20 “Rule” and YNAB Go Together like Peanut Butter and Jelly

I am a huge fan of both the 50-30-20 “rule” and YNAB and I thought I would write a post about how the two can go together to help you gain clarity of your financial health and control of your money. The two really do go together like peanut butter and jelly (with sincere apologies to my dear family member with a peanut butter allergy). I go through this process with my coaching clients and have found that it works quite well!

YNAB and the 50-30-20 Rule: The Basics

If you’re reading this you probably already know what YNAB is. But if you don’t, YNAB is a website budgeting application that has been a primary tool in my financial journey over the past several years. I started using it personally, then I got my husband into it for our shared budget, and now I help others use it as a coach. YNAB has four “rules” but the main one is to “give every dollar a job”. In other words, it is zero-based budgeting. In the app, you assign the dollars in your bank accounts into custom categories that you set up. As you spend, the amount available in the categories decreases. As new money comes in, you assign it to the categories again. Rinse and repeat. There is so much more to it of course, but that is the basic premise.

I explore what the 50-30-20 rule is in another post which I encourage you to check out. To give you a quick explanation, the 50-30-20 rule isn’t really a rule. It is more of a guideline to follow on how to allocate your money so that you are living within your means and saving for the future. The 50-30-20 rule simply means that a maximum of 50% of your income should go to your “needs”, a maximum of 30% of your income should go to your “wants”, and at least 20% of your income should go to your “goals” (extra debt payments, savings, and/or investments combined). It applies best for people who are in their working years. The 50-30-20 rule will guide you to look at your overall percentages and find areas that you can adjust to bring you back to closer to the ideal percentages.

Let’s Put YNAB and the 50-30-20 rule together!

As I mentioned, if you’re looking to gain clarity of your financial health and control over your money, the 50-20-30 rule and YNAB work really well together.

Essentially, the 50-30-20 rule will give you a birds eye view of your overall financial health and you can then use this information to make some big and/or small changes to your spending and saving to bring them closer in line with the 50-30-20 ideal. Then, YNAB is the tool to put your plan in place.

Here’s an explanation of how it can all work.

Step 1: Review Your Past Spending and Saving

The first step is to look at your actual spending and saving based on the past three to six months of bank statements. Group your transactions in categories that make sense to you (rent, mortgage, groceries, dining out, debt payments, kids, gifts, investing etc..). Then, calculate an average amount for each category. The average could be monthly, yearly, or weekly. Then, think about any infrequent purchases that may not have been captured in the bank statements. For example, Christmas gifts, travel, yearly subscriptions etc.. If you’re already a YNAB user, there will be no need to go through your bank statements like this. Just use the reporting feature already available in YNAB to determine your average spending for your categories.

Once you’ve got average amounts for each of your categories, plug the averages into the Financial Fit Check. The Financial Fit Check is a free and very easy to use tool that you can use to see how close your spending and saving is to the 50-30-20 rule. You simply plug in your numbers and then check the “Your Results” tab to see the result. There is absolutely no math or formulas to use. For each category, you’ll have to decide if it falls under “needs”, “wants”, “savings”, “debt payments” or “investments”. You can even put in weekly, bi-weekly, or yearly amounts and the tool will automatically calculate the monthly amount. Here is the link to learn more about the tool.

Step 2: Adjust Your Financial Fit Check

Once you’ve completed the Financial Fit Check, have a look at the “Your Results” tab and see how your percentages compare to the 50-30-20 ideal. Are there any adjustments you’d like to make going forward? If so, it’s time to create a new copy of the Financial Fit Check. On this new copy, make the necessary adjustments that are in line with your financial goals. Go ahead and play around with it! For example, if you have a goal of paying off credit card debt, you’ll want to increase how much you are putting towards the debt each month and make an equivalent adjustment to a “need” or a “want” to compensate for this. If one of your goals is to save for a trip, you can increase the amount you are saving for travel. If you want to save more for retirement, you can bump up this amount and make an adjustment down somewhere else. The key is to make sure that your total expenses (this includes savings, debt payments etc..) is the same as your income on the “Your Results” tab.

Step 3: Set Up or Adjust YNAB to Line up with Your Financial Fit Check

Now it’s time to set your new plan in motion. Create category groups in YNAB called “Needs”, “Wants”, and “Goals”. In each category group, create categories that match what you’ve already got in the Financial Fit Check. For each category, create a target that matches the amount in your second (new and improved) version of the Financial Fit Check. And just like that, your YNAB budget lines up perfectly with the Financial Fit Check and your goals!

Here’s what it would look like:

Using Category Groups to Set up the 50-30-20 Rule in YNAB

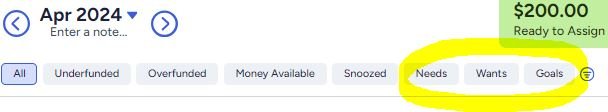

If you’d prefer to organize your budget in a different way with different category groups, you can also use YNAB’s new(ish) feature called “Focused Views”. More here on how focused views work. You would create a custom view for your “needs”, “wants”, and “goals”. This is how I’ve got my own budget set up and quite like it.

Here’s how this would look:

Using Focused Views to Set Up the 50-30-20 Rule in YNAB

Conclusion

The 50-30-20 rule and YNAB provide a perfect combination of clarity and control, two essential phases on your journey towards meeting your financial goals. I encourage you to download my free tool, the Financial Fit Check and give it a try. I would be happy to answer any questions you have as well, don’t be shy to reach out or ask a question in the comments below. And if you would like to book a call with me to chat about what one-on-one money coaching with me would look like, here’s the link to book.

Don’t miss another new post! Subscribe to my newsletter where you'll receive money management tips, personal updates (including very cute Bella the Beagle content), and more!

Want to learn more about my money coaching programs? Check out my web site.

Interested in seeing how your finances stack up against the 50-30-20 rule? Download the Financial Fit Check, a free resource.